Money 4 3 1 – Your Sweetest Accounting Application

- Money 4 3 1 – Your Sweetest Accounting Application Free

- Money 4 3 1 – Your Sweetest Accounting Application Online

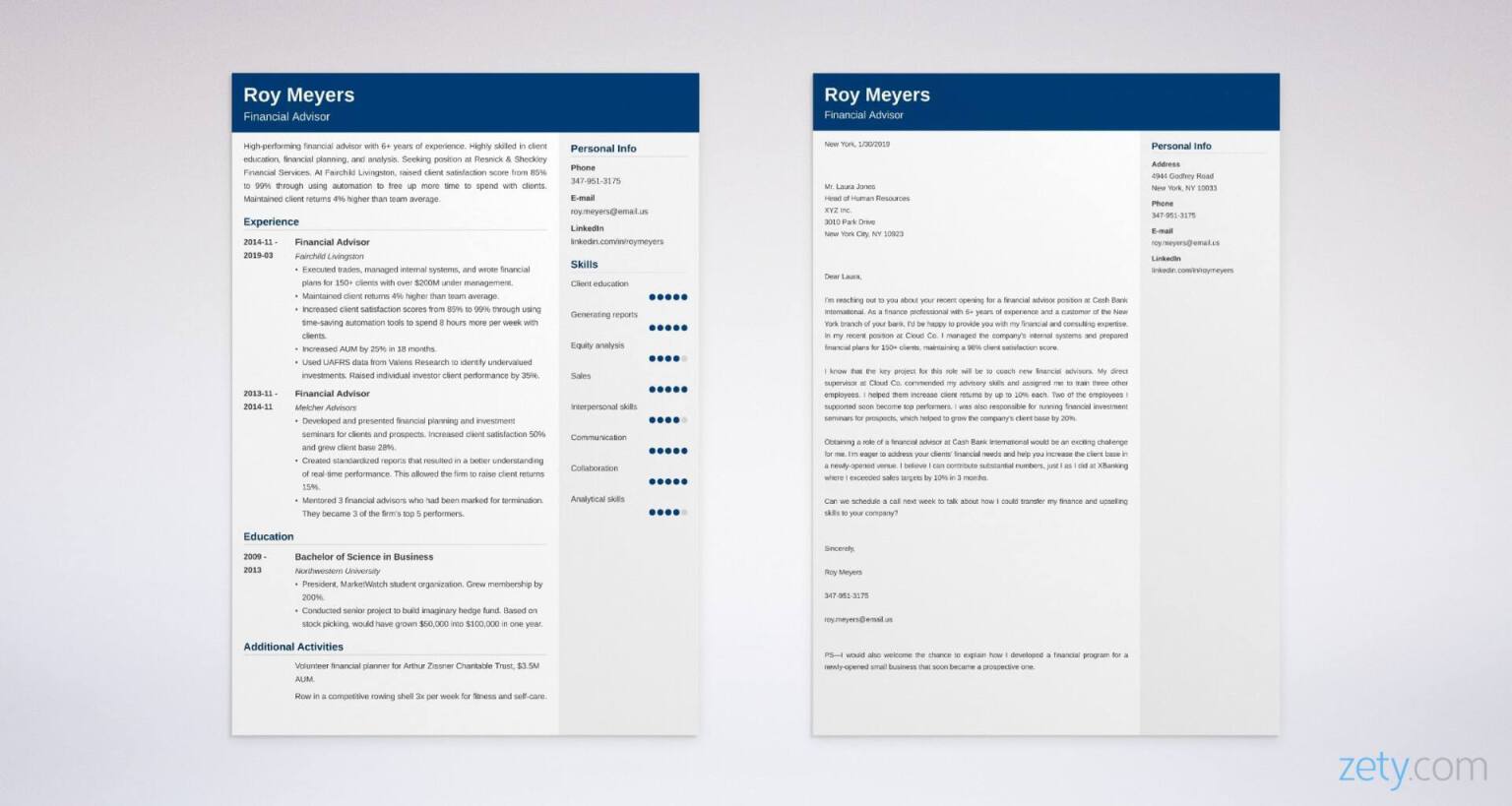

- Money 4 3 1 – Your Sweetest Accounting Application Letter

- Money 4 3 1 – Your Sweetest Accounting Application Notes

- Money 4 3 1 – Your Sweetest Accounting Application Pdf

The revenue recognition principle, or just revenue principle, tells businesses when they should record their earned revenue. The Blueprint breaks down the RRP.

An accounting journal is an accounting worksheet that allows you to track each of the steps of the accounting process, side by side. This accounting journal template includes each step with sections for their debits and credits, and pre-built formulas to calculate the total balances for each column. As you use the Excel accounting template on your own computer or laptop, you have full control over your content. We recommend storing your template in the cloud (e.g. Using OneDrive), so you can always access your template anywhere in the world.

The developer has stated that it has also done a small number of miscellaneous bug fixes. A new license for Money 2 can be purchased for $40. Cafeina Soft has also released its Personal Finance 2.4: the accounting application brings minor bug fixes and aesthetic changes as well as a number of different quirks in the application. The consolidation method is a type of investment accounting used for consolidating the financial statements of majority ownership investments. This method can only be used when the investor possesses effective control of a subsidiary, which often assumes the investor owns at least 50.1%.

For additional practice and exposure in journalizing transactions, we will be showing more examples of business transactions and their journal entries.

The transactions in this lesson pertain to Gray Electronic Repair Services, our imaginary small sole proprietorship business.

For account titles, we will be using the chart of accounts presented in an earlier lesson.

All transactions are assumed and simplified for illustration purposes.

Note: We will also be using this set of transactions and journal entries in later lessons when we discuss the other steps of the accounting process.

Money 4 3 1 – Your Sweetest Accounting Application Free

Let's start.

Transaction #1: On December 1, 2019, Mr. Donald Gray started Gray Electronic Repair Services by investing $10,000. The journal entry should increase the company's Cash, and increase (establish) the capital account of Mr. Gray; hence:

| Date 2019 | Particulars | Debit | Credit | |

|---|---|---|---|---|

| Dec | 1 | Cash | 10,000.00 | |

| Mr. Gray, Capital | 10,000.00 | |||

Transaction #2: On December 5, Gray Electronic Repair Services paid registration and licensing fees for the business, $370.

First, we will debit the expense (to increase an expense, you debit it); and then, credit Cash to record the decrease in cash as a result of the payment.

| 5 | Taxes and Licenses | 370.00 |

|---|---|---|

| Cash | 370.00 |

Transaction #3: On December 6, the company acquired tables, chairs, shelves, and other fixtures for a total of $3,000. The entire amount was paid in cash.

There is an increase in an asset account (Furniture and Fixtures) in exchange for a decrease in another asset (Cash).

Money 4 3 1 – Your Sweetest Accounting Application Online

| 6 | Furniture and Fixtures | 3,000.00 |

|---|---|---|

| Cash | 3,000.00 |

Transaction #4: On December 7, the company acquired service equipment for $16,000. The company paid a 50% down payment and the balance will be paid after 60 days.

This will result in a compound journal entry. There is an increase in an asset account (debit Service Equipment, $16,000), a decrease in another asset (credit Cash, $8,000, the amount paid), and an increase in a liability account (credit Accounts Payable, $8,000, the balance to be paid after 60 days).

| 7 | Service Equipment | 16,000.00 |

|---|---|---|

| Cash | 8,000.00 | |

| Accounts Payable | 8,000.00 |

Transaction #5: Also on December 7, Gray Electronic Repair Services purchased service supplies on account amounting to $1,500.

The company received supplies thus we will record a debit to increase supplies. By the terms 'on account', it means that the amount has not yet been paid; and so, it is recorded as a liability of the company.

| 7 | Service Supplies | 1,500.00 |

|---|---|---|

| Accounts Payable | 1,500.00 |

Transaction #6: On December 9, the company received $1,900 for services rendered. We will then record an increase in cash (debit the cash account) and increase in income (credit the income account).

| 9 | Cash | 1,900.00 |

|---|---|---|

| Service Revenue | 1,900.00 |

Transaction #7: On December 12, the company rendered services on account, $4,250.00. As per agreement with the customer, the amount is to be collected after 10 days. Under the accrual basis of accounting, income is recorded when earned.

In this transaction, the services have been fully rendered (meaning, we made an income; we just haven't collected it yet.) Hence, we record an increase in income and an increase in a receivable account.

| 12 | Accounts Receivable | 4,250.00 |

|---|---|---|

| Service Revenue | 4,250.00 |

Transaction #8: On December 14, Mr. Gray invested an additional $3,200.00 into the business. The entry would be similar to what we did in transaction #1, i.e. increase cash and increase the capital account of the owner.

| 14 | Cash | 3,200.00 |

|---|---|---|

| Mr. Gray, Capital | 3,200.00 |

Transaction #9: Rendered services to a big corporation on December 15. As per agreement, the $3,400 amount due will be collected after 30 days.

| 15 | Accounts Receivable | 3,400.00 |

|---|---|---|

| Service Revenue | 3,400.00 |

Transaction #10: On December 22, the company collected from the customer in transaction #7. We will record an increase in cash by debiting it. Then, we will credit accounts receivable to decrease it. We are reducing the receivable since it has already been collected.

| 17 | Cash | 4,250.00 |

|---|---|---|

| Accounts Receivable | 4,250.00 |

Actually, we simply transferred the amount from receivable to cash in the above entry.

Transaction #11: On December 23, the company paid some of its liability in transaction #5 by issuing a check. The company paid $500 of the $1,500 payable.

To record this transaction, we will debit Accounts Payable for $500 to decrease it by the said amount. Then, we will credit cash to decrease it as a result of the payment. The entry would be:

| 20 | Accounts Payable | 500.00 |

|---|---|---|

| Cash | 500.00 |

Accounts payable would now have a credit balance of $1,000 ($1,500 initial credit in transaction #5 less $500 debit in the above transaction).

Transaction #12: On December 25, the owner withdrew cash due to an emergency need. Mr. Gray withdrew $7,000 from the company.

We will decrease Cash since the company paid Mr. Gray $7,000. And, we will record withdrawals by debiting the withdrawal account – Mr. Gray, Drawings.

| 25 | Mr. Gray, Drawings | 7,000.00 |

|---|---|---|

| Cash | 7,000.00 |

Transaction # 13: On December 29, the company paid rent for December, $ 1,500. Again, we will record the expense by debiting it and decrease cash by crediting it.

| 29 | Rent Expense | 1,500.00 |

|---|---|---|

| Cash | 1,500.00 |

Transaction #14: On December 30, the company acquired a $12,000 short-term bank loan; the entire amount plus a 10% interest is payable after 1 year.

Again, the company received cash so we increase it by debiting Cash. The company now has a liability. We will record it by crediting the liability account – Loans Payable.

| 30 | Cash | 12,000.00 |

|---|---|---|

| Loans Payable | 12,000.00 |

Transaction #15: On December 31, the company paid salaries to its employees, $3,500.

Money 4 3 1 – Your Sweetest Accounting Application Letter

For this transaction, we will record/increase the expense account by debiting it and decrease cash by crediting it. (Note: This is a simplified entry to present the payment of salaries. In actual practice, different payroll accounting methods are applied.)

Money 4 3 1 – Your Sweetest Accounting Application Notes

| 31 | Salaries Expense | 3,500.00 |

|---|---|---|

| Cash | 3,500.00 |

Money 4 3 1 – Your Sweetest Accounting Application Pdf

There you have it. You should be getting the hang of it by now. If not, then you can always go back to the examples above. Remember that accounting skills require mastery of concepts and practice.